Strike price

In options, the strike price (or exercise price) is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the spot price (market price) of the underlying instrument at that time.

Formally, the strike price can be defined as the fixed price at which the owner of an option can purchase (in the case of a call), or sell (in the case of a put), the underlying security or commodity.

For example, an IBM May 50 Call has a strike price of $50 a share. When the option is exercised the owner of the option will buy 100 shares of IBM stock for $50 per share.

Contents |

Moneyness

Moneyness is a term describing the relationship between the strike price of an option and the current trading price of its underlying security. Where settlement is financial, the difference between the strike price and the spot price will determine the value, or "moneyness", of the contract.

In options trading, terms such as in-the-money, at-the-money and out-of-the-money describe the moneyness of options.

A call option is in-the-money if the strike price is below the market price of the underlying stock. A put option is in-the-money if the strike price is above the market price of the underlying stock.

A call or put option is at-the-money if the stock price and the exercise price are the same (or close).

A call option is out-of-the-money if the strike price is above the market price of the underlying stock. A put option is out-of-the-money if the strike price is below the market price of the underlying stock.

Mathematical Formula

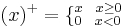

A call option has positive monetary value at expiration when the underlying has a spot price (S) above the strike price (K). Since the option will not be exercised unless it is in-the-money, the payoff for a call option is

also written as

where

A put option has positive monetary value at expiration when the underlying has a spot price below the strike price; it is "out-the-money" otherwise, and will not be exercised. The payoff is therefore:

or

For a digital option payoff is  , where

, where  is the indicator function.

is the indicator function.

See also

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

|

|||||||||||||||||||||||||||||||||||||

![\max\left[(S-K);0\right]](/2012-wikipedia_en_all_nopic_01_2012/I/8725ed56cd83ba8cc49bed38b4a83982.png)

![\max\left[(K-S);0\right]](/2012-wikipedia_en_all_nopic_01_2012/I/afce2bb48edb3e113ae57ae862a2b32a.png)